If your child has submitted the Free Application for Federal Student Aid (FAFSA®) and you are waiting to find out how much financial aid you’ll receive, now is a great time to explore additional options for covering costs.

If your child has submitted the Free Application for Federal Student Aid (FAFSA®) and you are waiting to find out how much financial aid you’ll receive, now is a great time to explore additional options for covering costs.

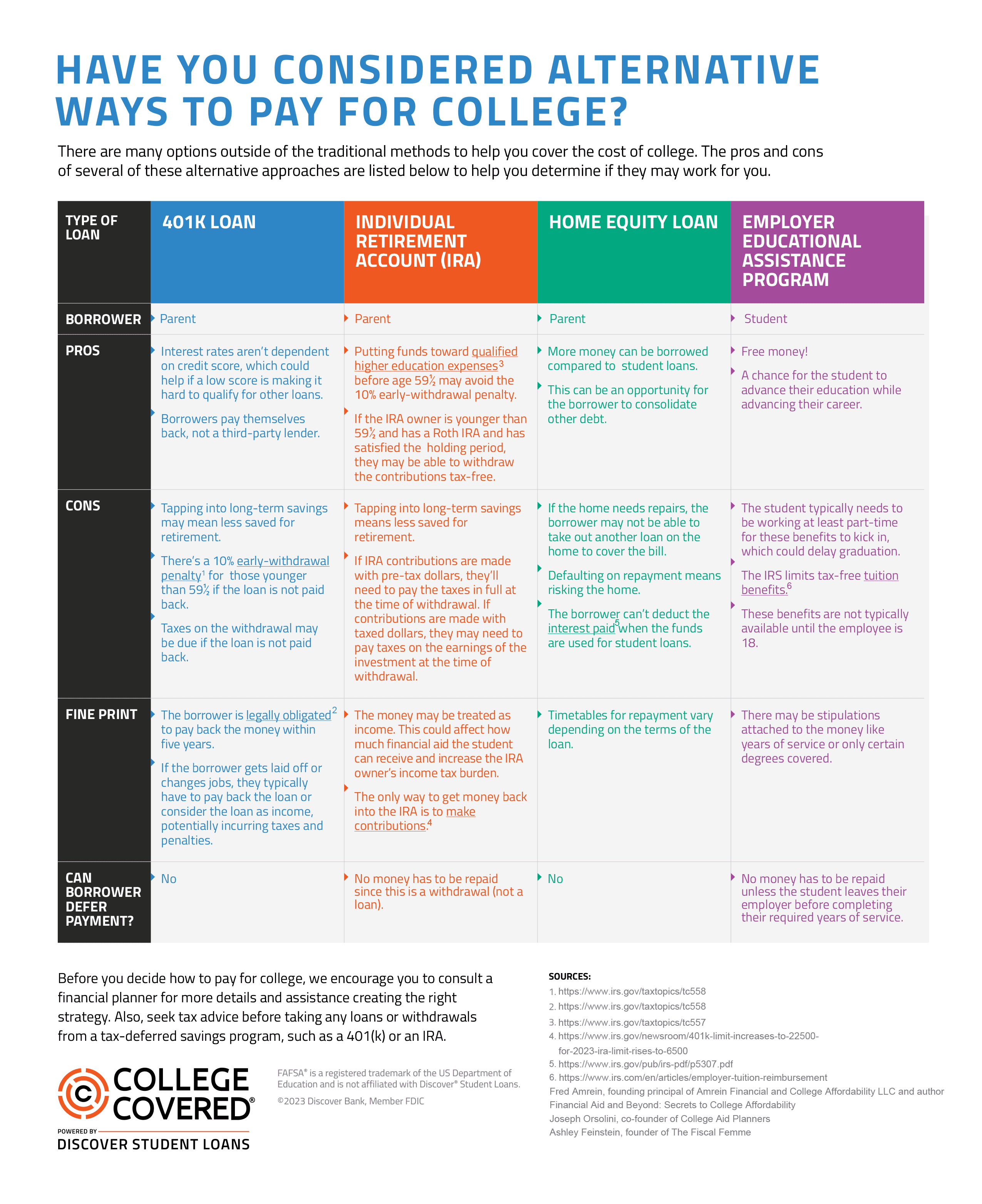

You likely know about the traditional methods—savings, scholarships, grants, and student loans—but there are other avenues that may be right for your family. This can include tapping into the equity on your home or using retirement savings to help pay for college tuition. Be cautious and weigh the pros and cons when it comes to accessing funds earmarked for retirement. There are loans available for college, but there are no loans for retirement.

You also may think outside the box when it comes to how to cover tuition. For example, if your student balances work and school, they may be able to find employment with a company that offers tuition reimbursement. Similarly, your employer may have tuition assistance or scholarships available for children of employees. Another option is attending a community college for the first year or two of undergrad to save money on tuition. If your student is able to swing working part-time while going to school, then that’s even more money they can put toward the bill.

As you consider how to cover tuition, it may be helpful to work with a financial advisor to assess which strategy may be the best for your unique financial situation. Not only can a financial advisor help you understand your options, but they can also help you prepare for any tax implications before you take any loans or withdrawals.

FAFSA® is a registered trademark of the US Department of Education and is not affiliated with Discover® Student Loans.

Discover® Student Loans encourages you to consult a financial planner before making financial transactions. You should also consult a tax professional for tax advice.