If the financial aid package offered in your award letter isn’t everything you hoped it would be, you can negotiate it.

Yes, financial aid is negotiable. “There is very little downside to asking, so you might as well make the request,” says Shannon Vasconcelos, a college finance educator at College Coach. She estimates that negotiations are successful in about half of the cases she’s seen, so it’s worthwhile to put the effort in.

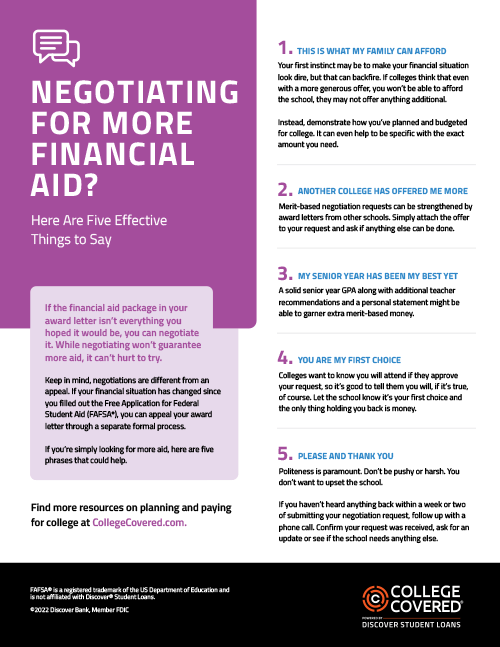

Keep in mind, negotiations are different from an appeal. If your financial situation has changed due to special circumstances (e.g., job loss, illness) since you filled out the Free Application for Federal Student Aid (FAFSA®), you can appeal your award letter. Unlike negotiating, submitting an appeal is a formal process, so contact the school to see what steps you need to take to get a professional judgment review.

If your financial situation has not changed since you completed the FAFSA and you’re simply hoping for more aid, your request is a negotiation, not an appeal. Here are six key phrases you can use in your negotiation, depending on your situation.

1. This Is What My Family Can Afford.

Your first instinct may be to make your financial situation look dire, but that technique can backfire. “Colleges typically have a limited budget,” says Vasconcelos. “If they think that, even with their most generous offer, you still won’t be able to afford the school, they may not be willing [or able] to offer you anything additional.” Instead, she recommends demonstrating how you’ve planned and budgeted for college. It is also helpful to include that you are prepared to borrow to help pay for college if that is the case for your family.

2. I Need $X to Attend.

If you’re being transparent about what you can afford, you might as well be specific. Susan Miller of Chicago was able to secure her son more merit aid by asking for a specific amount. “We asked for an additional $2,500, and that’s what we received,” Miller says. “I think it felt like a manageable request, and it adds up over four years.”

3. College X Has Offered Me More.

Merit-based negotiation requests “can be strengthened by award letters from other schools,” Blaine Blontz, founder of Financial Aid Coach, says. Simply attach the offer along with other supporting documents (e.g., third-quarter grades, new test scores, additional recommendations) to your request and ask if anything else can be done.

4. My Senior Year Has Been My Best Yet.

Seniors have a reputation for slacking off, but those who don’t may be rewarded. Miller was able to get her son a small scholarship by showing how he had gone from an A-B student to a straight-A student his senior year. “We attached his latest report card, additional teacher recommendations and a personal statement to our request,” she says.

5. You Are My First Choice.

Of course, only say this when it’s true. Colleges want to know you will attend if they approve your request, so it’s good to tell them you will. Let the school know it’s your first choice and the only thing holding you back is money.

6. Please and Thank You.

Politeness is paramount in your request. “Families should approach the [negotiation] process with respect,” says Blontz. “Don’t be pushy or harsh. You don’t want to upset the school.”

Once you submit your written negotiation request, it’s time to wait. If you have not heard anything in a week or two, follow up with a phone call. You can confirm your request was received, ask for an update or see if the school needs anything else. If you still don’t have enough financial aid after the negotiation process, you can look into other ways to make up the difference.

FAFSA® is a registered trademark of the US Department of Education and is not affiliated with Discover® Student Loans.